Understanding how Medicare premiums are determined is crucial for anyone approaching retirement or already enrolled in the program. Let’s take a closer look at the factors that influence your Medicare costs in 2024 and beyond.

Income-Related Monthly Adjustment Amount (IRMAA)

Your income plays a significant role in determining your Medicare premium. If your modified adjusted gross income (MAGI) exceeds certain thresholds, you’ll be subject to an Income-Related Monthly Adjustment Amount (IRMAA). This surcharge is added to your standard Part B (medical insurance) and Part D (prescription drug coverage) premiums.

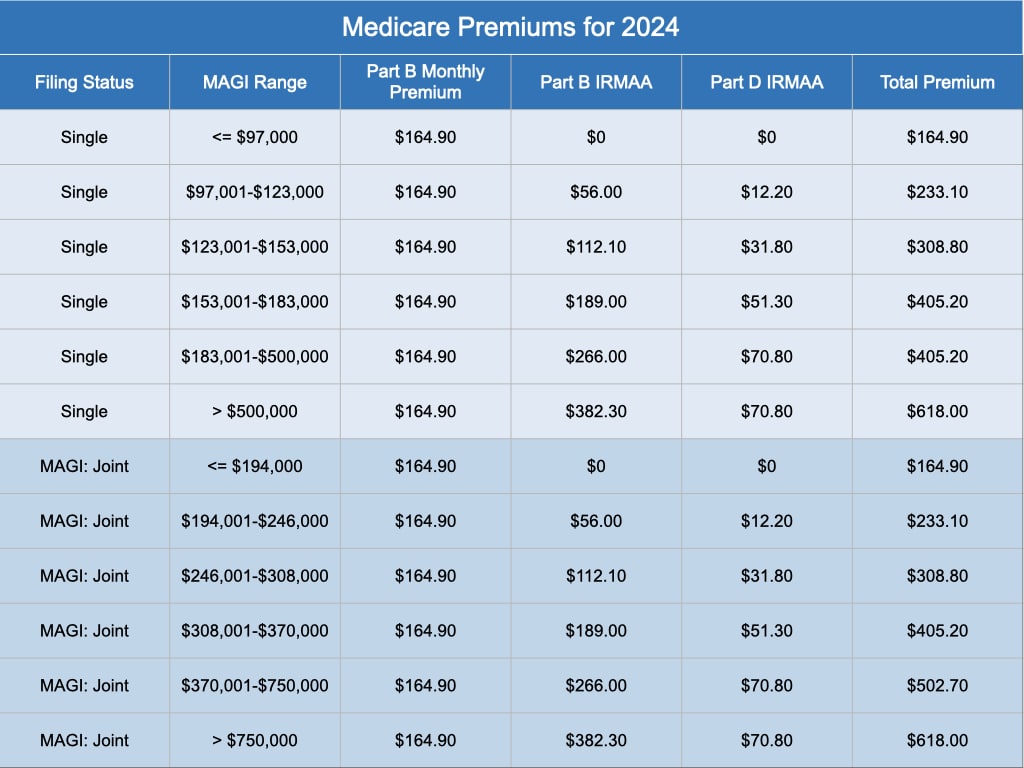

For 2024, the IRMAA thresholds are as follows:

- Single filers:

- No IRMAA if MAGI is $97,000 or less

- IRMAA applies if MAGI is above $97,000

- Married couples filing jointly:

- No IRMAA if MAGI is $194,000 or less

- IRMAA applies if MAGI is above $194,000

The specific IRMAA amounts you’ll pay depend on your income level and are tiered. It’s advisable to consult the official Medicare website or your financial advisor for the most current IRMAA tables.

Medicare Premiums in 2024

Medicare premiums are influenced by the projected cost of healthcare services, not a fixed benchmark like the Consumer Price Index (CPI).

For 2024, the standard monthly premium for Medicare Part B is $164.90. However, remember that this amount can increase significantly due to IRMAA if your income exceeds the thresholds.

Enrollment Periods and Penalties

Timely enrollment in Medicare is crucial. Failing to enroll in Part B when you’re first eligible can result in a late enrollment penalty, which increases your premium permanently.

Here’s a quick recap of the key enrollment periods:

- Initial Enrollment Period: This 7-month window starts three months before your 65th birthday and ends three months after.

- General Enrollment Period: If you missed your Initial Enrollment Period, you can sign up between January 1 and March 31 each year, with coverage starting on July 1. However, you may face late enrollment penalties.

- Special Enrollment Period: If you’re still covered by an employer-sponsored health plan, you may qualify for a Special Enrollment Period, allowing you to enroll in Medicare without penalty after your employment or group coverage ends.

Beyond the Basics

In addition to the information covered above, it’s worth considering other factors that can influence your Medicare costs:

- Medicare Advantage Plans: These private plans offer an alternative to Original Medicare (Parts A and B) and often include prescription drug coverage (Part D). Premiums for Medicare Advantage plans can vary widely, so it’s important to compare your options carefully.

- Medigap Plans: These supplemental insurance policies can help cover out-of-pocket costs like deductibles and coinsurance that Original Medicare doesn’t pay. Medigap premiums are also subject to change.

Navigating the complexities of Medicare can be challenging, but understanding how premiums are determined is an essential first step. By staying informed about IRMAA, enrollment periods, and other factors affecting your costs, you can make more informed decisions about your healthcare coverage in retirement. Remember, a trusted financial advisor can provide personalized guidance based on your unique circumstances.

Contact us if you have questions and would like to discuss this.